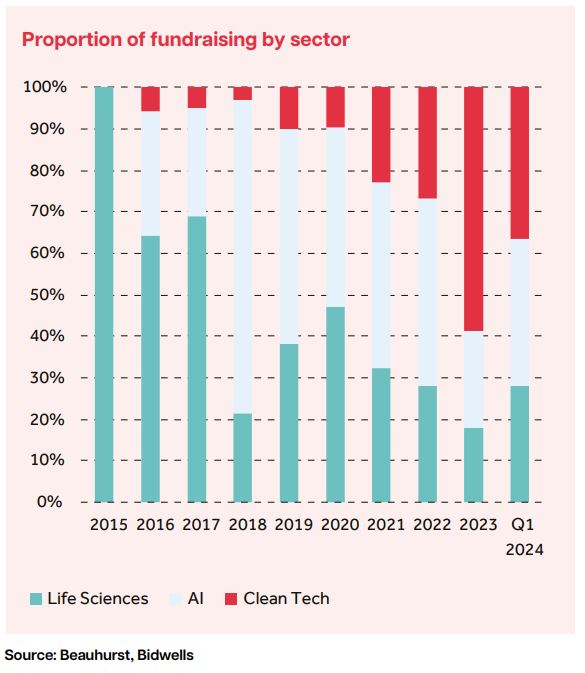

These funding trends inevitably impact the ability of companies to scale. In our survey of SMEs, life science companies report finance to be the greatest barrier to growth, with similar challenges seen in the automotive and tech hardware sectors. In contrast, the energy and environmental sectors are the least concerned about finance, although they are challenged in other ways, particularly access to talent, a point discussed elsewhere in this report.

Similarly, as noted above, some regions appear better able to attract funding and talent than others. Such imbalances tend to be self-reinforcing and underpin future inequality. This imbalance in delivering growth support to innovative companies is an opportunity cost for the country as a whole.

A strategic play for growth

While the UK’s innovative future will depend on liquid and well-funded capital markets, the imbalances in funding suggest a strategic approach to growing and scaling our innovative economy is needed. This is perhaps illustrated by the agri-tech sector, in which the UK has a strong position, exemplified by the growing critical mass in Norwich, which has benefited from some public research funding. The challenge of scaling companies and building clusters of critical mass requires greater commitment, as well as support for strategic links across the country. Virtual clusters can be engineered but cannot be achieved piecemeal.

There is a cost to delaying growth. In addition to funding challenges, over recent years a lack of appropriate science or technical space has seen vested capital sit dormant. This position is being addressed in markets such as Oxford, Cambridge, and London, where lab and other technical floorspace is coming forward, but the challenge of the provision of suitable scientific space persists. However, viability challenges derived from higher finance costs have stalled the delivery of science and technical business space across much of the country. 46% of SMEs in our survey located outside the Golden Triangle report access to property as a key barrier to their growth, compared with 31% of those located within the region.

In our survey, 100% of those businesses occupying the smallest floorspace bracket report a lack of property to be their companies’ greatest barrier to growth. This is also a particular challenge for larger space users in the chemical, industrials, and automotive sectors, which report the lack of suitable business space as their greatest barrier to growth, second only to finance.

Crucially, other specialist space and facilities need to develop in parallel with our SME ecosystem. The evolution of the UK’s science and tech economy will depend on the delivery of data centres, quantum computing facilities, and GMP space. There is little point in developing new innovative therapeutics if the testing and manufacturing go elsewhere in the world.

Not just an ‘SME issue’

These challenges are not, of course, just the preserve of spinouts and start-ups. For mature companies, there is often a very high opportunity cost to investing in innovative ventures, even though returns from innovation investments are dominated by the “transformational realm.”

Crucially, many of the sectors in which these apparently stable mature companies operate are facing an unprecedented period of disruption and change. The failure of innovation in the economy, whether in their own business or among the army of SMEs across specialist sectors on which they depend, will have long-term negative implications that will directly impact shareholder value.

The potential for innovation in the energy and transport sectors is evident. Meanwhile, in the life science sector, large pharma companies have relied on specialist SMEs for R&D in cell, gene, and mRNA technologies to revolutionise medicine. The manufacturing of drugs is being transformed by robotics, and across all such areas, AI is just starting on its path to transforming how science is undertaken.

The economic and social opportunity cost of not supporting UK innovation beyond the idea cannot be contemplated.