Briefing

17.01.22

Briefing

17.01.22

We're in an agricultural transition period - what does that mean for UK farmers?

Are you looking for a home?

Visit our Residential website

Biodiversity Units

Search for available Biodiversity Units listed for sale

Our Projects

A track record to be proud of

Our People

Meet our team of dedicated, skilled professionals

The Productivity Engine

“Productivity isn’t everything, but, in the long run, it is almost everything”

Market Databooks

Key trends in office, laboratory and industrial

Looking to work with us?

Be part of better

Our offices

Locations across the UK

Our Projects

A track record to be proud of

Recent news

Read all the latest news from Bidwells

17.1.22 2 minute read

Agricultural commodities

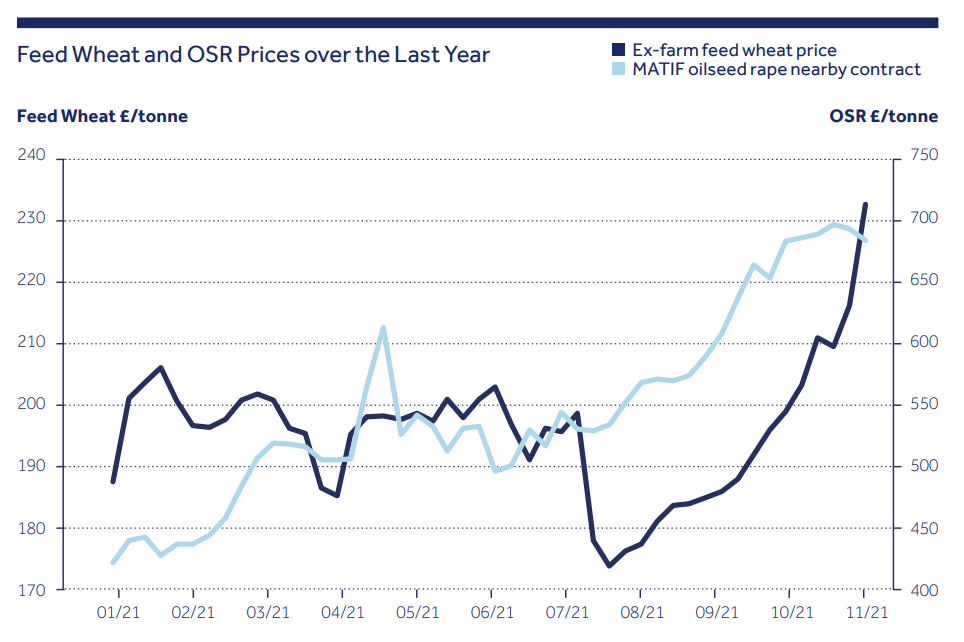

The reason for the increase in grain price is that stock levels for wheat in major exporting countries are down to their lowest levels since 2008. Coupled with the tight supply of wheat in the northern hemisphere due to adverse weather in the US, Canada and Russia has driven up global prices. The result of the current southern hemisphere harvest, particularly Australia, will determine whether the market remains bullish, although it depends on freight capacity and readiness as to how quickly and to what extent this will affect the global market. If there is a poor southern hemisphere harvest, it could push the global grain price even higher.

There is, however, a question around how much further the market can lift. There are already signals that the current strength in the wheat market may be starting to take its toll on the big importers: Egypt’s state grain buyer GASC cancelled a tender for December delivery, stating that the prices were simply too high.

Domestically, UK feed wheat delivered into East Anglia in December 2021 was at £224/t, which is a big jump on the £170/t which we were happy to receive in November 2020. Supporting this price rise is that an E10 ethanol blend for petrol has been introduced since September for which wheat is the main feed stock. Alongside this, there has been an increase in animal feed use for wheat as animals are staying on farm longer prior to slaughter, due to logistical issues within the abattoir industry.

The rise in the grain price can be dwarfed by the increases seen in the price of oilseed rape. The recent support within the oilseed market is due to a variety of reasons including soyameal demand, US export demand and tight global supply. The global bullish trend within the oilseed market has transpired into our domestic rapeseed market. Delivered OSR into the Erith factory, February 2022, has been quoted at £612/t and that doesn’t include any oil bonuses.

However, it is not all good news, when the cereal and oilseed prices are indexed against energy prices, crude oil and natural gas are proportionally more expensive than agricultural commodities in comparison to last year. The strong natural gas and energy price is inflating the input costs for harvest 2022, notably fertiliser, but the current harvest 2022 contracts are at a discount to the nearby prices (Nov 2022 Feed wheat delivered to store is at £194/t). When we combine the increase in grain price and input costs with the reduction in BPS we believe that farms will be on average £70/ha better off in harvest 2022, so long as all other things remain equal.

Briefing

17.01.22

Briefing

17.01.22

As the reports show, we are now in an agricultural transition period. Changes for farmers will be phased in over seven years and over this time, the Basic Payment Scheme (BPS) will be gradually reduced in a tiered system.

We're in an agricultural transition period - what does that mean for UK farmers?

Reports & Briefings

09.02.22

Reports & Briefings

09.02.22

In 2019, the UK and Scottish Governments made their commitments to net zero, with target dates of 2050 and 2045 respectively. Relatively, both countries are progressing well, with emissions falling faster than in other major developed economies. However, with 326m tonnes of ‘carbon dioxide equivalent (CO2e)’ emitted in 2020, there is still a long road ahead.

The reality of the UK’s net zero ambition: the role of carbon capture

Sign up to receive personalised property alerts, and to hear the latest news, insight and advice from our experts

Visit our preference centre to subscribe to insights, research or property alerts